Business

CBN holds interest rate at 27.5%, reinforce disinformation, maintain economic stability

The Central Bank of Nigeria (CBN) has maintained the current Monetary Policy Rate (MPR) of 27.5 per cent with all policy parameters.

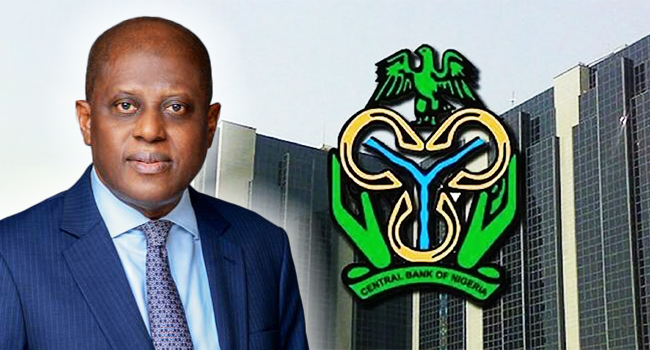

The Governor of CBN, Olayemi Cardoso, disclosed this at the MPC briefing in Abuja on Tuesday.

The apex bank’s MPC held its 301 meeting on July 21st and 22nd, 2025, to review recent economic and financial developments and outlook.

He said that the CBN’s decision to maintain the current MPR was premised on the need to continue to ensure the ongoing disinflation while vigorously ensuring declining prices.

The Committee also retained the asymmetric corridor at +500/-100 basis points around the MPR, leaving the Cash Reserve Ratio at 50 per cent for Deposit Money Banks and a general Liquidity Ratio of 30 per cent.

The CBN boss revealed that as of July 18, the nation’s foreign reserve stood at 40.1 billion, which could provide import cover of nine and a half months.

He said the monetary and fiscal authorities would continue to work together to reduce the nation’s inflation rate to a single digit.

Cardoso said the decision was premised on the need to sustain the momentum of this inflation and sufficiently contain price pressures.

According to him, maintaining the current policy stance will continue to address the existing and emerging inflationary pressure.

“The MPC will continue to undertake rigorous assessment of economic conditions, price outlook to inform future decisions.

“The MPR acknowledged the decline in headline inflation in June 2025, the third consecutive month of deceleration driven by moderation in energy prices and stability in the foreign exchange market.

“Despite these positive developments, members observe the uptick in month-on-month headline inflation, suggesting the presence of underlying price pressures,” he said.

The continued global uncertainties associated with the current tariff wars and geopolitical tensions could further exacerbate supply chain disruption and exert pressure on prices of imported items.

The CBN’s decision reflected its commitment to maintaining tight monetary conditions to curb inflationary trends while fostering an environment conducive to sustainable growth.