Business

Seplat Energy’s pross profit soars to N751.2bn in H1 2025

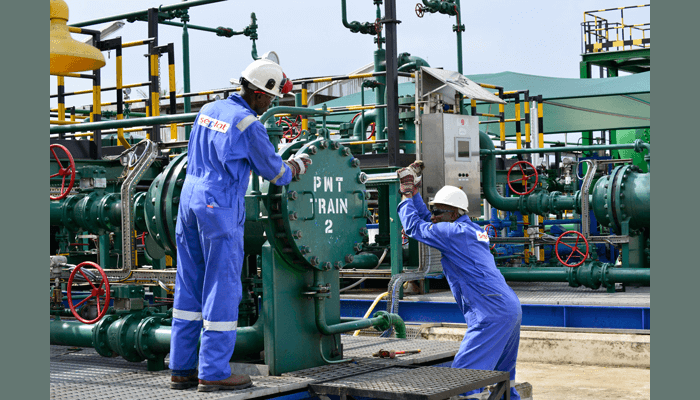

Seplat Energy Plc, a Nigerian independent energy company listed on both the Nigerian Exchange (NGX) and the London Stock Exchange, has announced its unaudited results for the six months ended June 30, 2025.

The company reported a significant increase in revenue, gross profit, and cash generated from operations.

Seplat announced this in a statement issued on Wednesday, signed by its Director, External Affairs & Social Performance, Chioma Afe.

According to the statement, “Cash generated from its operations for the period grew to N1.188 trillion from N308.2 billion year-on-year, whilst operating profit rose to N601.2 billion from N285.2 billion year-on-year.”

Seplat Energy’s revenue for the six months ended June 30, 2025, was N2.167 trillion, compared to N575.1 billion in the same period last year.

The company’s gross profit soared to N751.2 billion from N247.5 billion year-on-year.

Cash generated from operations grew to N1.188 trillion from N308.2 billion year-on-year.

Operating profit rose to N601.2 billion from N285.2 billion year-on-year.

Seplat Energy’s production for the period averaged 134,492 barrels of oil per day (boepd), up 178 per cent from 48,407 boepd in the same period last year.

Earnings before interest, taxes, depreciation, and amortization (EBITDA) for the half-year hit N1.139 trillion, representing a rise from N364.5 billion recorded in H1 2024.

Seplat Energy declared a dividend of US$ 4.6c/share, in line with the prior quarter dividend.

The company planned to set out a revised capital allocation policy in the Capital Markets Day scheduled for September 18, 2025.

Commenting on the results, Roger Brown, Chief Executive Officer of Seplat Energy Plc, said: “Seplat has continued its positive trajectory in Q2 to deliver a strong performance for the first half of 2025.

”Our focus on integrity, reliability, and production improvement activities are bearing fruit as evidenced by strong production in 2Q 2025,” he said.

Brown said that Seplat Energy is well-placed to weather the recent increase in macro volatility, with strong revenues and a focus on costs delivering significant positive cash flows.

He said that the company has reduced net leverage, continued its strong quarterly dividend track record, and paid down an additional $100 million of debt.

”The integration of the enlarged group continues at pace, and the company looks forward to sharing its exciting plans for the future at the upcoming Capital Markets Day in September, ” he added.