Nigerians express concern over rising debt despite Govt revenue claims

As the Federal Government continues to assert improvements in revenue generation, many Nigerians have voiced apprehension over the country’s escalating debt profile.

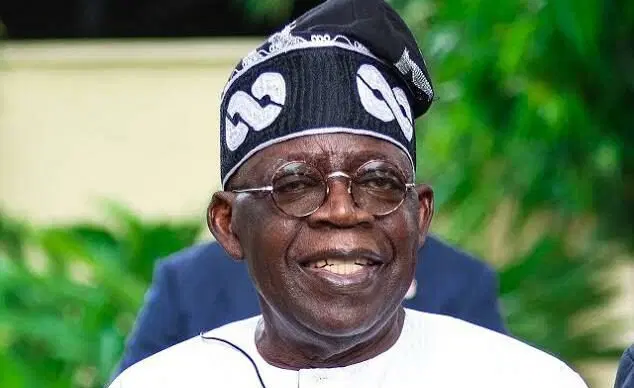

Concerns have intensified following recent approvals by the National Assembly for President Bola Tinubu to borrow N1.15 trillion from the domestic debt market to cover the 2025 budget deficit.

The 2025 budget, which sets total expenditure at N59.99 trillion—an increase of N5.25 trillion from the initial N54.74 trillion proposed by the executive, has created a total deficit of N14.10 trillion.

Out of this, N12.95 trillion has already been earmarked for borrowing.

Data from the Debt Management Office (DMO) indicate that as of June, Nigeria’s total public debt stood at N152.4 trillion, comprising N71.85 trillion in external debt and N80.55 trillion in domestic obligations.

Senator Olamilekan Adeola, Chairman of the Senate Committee on Appropriations, said that the borrowing plans had been integrated into the Medium-Term Expenditure Framework and the 2025 budget.

His words: “The borrowing is already embedded in the 2025 Appropriation Act.

”With this approval, we now have all revenue sources, including loans, in place to fully fund the budget,” he explained.

Senator Sani Musa, Chairman of the Senate Committee on Finance, defended the approach as consistent with global economic practices.

“There is no economy that grows without borrowing. What we are doing is in line with global best practices,” Musa stated.

However, some lawmakers and economic experts warn that the pace and scale of borrowing could pose long-term risks.

Senator Abdul Ningi stressed that Nigerians deserve detailed information on the loans and their intended impact.

Dr. Muda Yusuf, CEO of the Centre for the Promotion of Private Enterprise, highlighted that Nigeria’s rising debt service obligations were already outpacing capital expenditure and could crowd out essential government functions if not carefully managed.

“Debt service is already far more than the appropriation for capital spending, and the trend is worrying.

”We need to tread very cautiously with respect to debt commitments,” Yusuf said, noting that over 80 per cent of government revenue is now directed toward servicing debt.

Vahyala Kwaga, Deputy Country Director at BudgIT, echoed concerns, emphasising the need for transparency on the utilisation of past loans and warning that new borrowings risk breaching Nigeria’s debt threshold.

Bismarck Rewane, CEO of Financial Derivatives Company, cautioned that increased domestic borrowing could crowd out private investment, drive up interest rates, and limit credit availability for businesses, potentially fueling inflationary pressures.

Despite growing public concern, the Debt Management Office maintained that Nigeria’s debt remained sustainable.

Speaking at the recent Nigerian Economic Summit in Abuja, DMO Director-General Patience Oniha said that the country’s debt-to-GDP ratio currently stands at approximately 40 per cent, well below the 70 per cent benchmark for emerging economies.

Oniha emphasised that, by global standards, Nigeria’s borrowing level is not excessive.

As the debate continues, Nigerians remain watchful of how the government balances borrowing, revenue growth, and fiscal discipline amid mounting economic pressures.