NUPRC unveils 2025 petroleum licensing round, sets signature bonus between $3m and $7m

The Nigerian Upstream Petroleum Regulatory Commission (NUPRC) on Monday released comprehensive guidelines for its 2025 petroleum licensing round, revealing a signature bonus range of $3 million to $7 million.

The move aims to reduce entry barriers for investors while aligning with global best practices in upstream petroleum licensing.

A signature bonus is a one-time, upfront payment made by oil and gas companies to a government upon winning a licence or lease to explore or produce hydrocarbon resources.

It is effectively the “entry fee” for securing exploration or production rights.

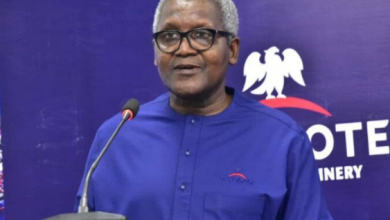

In a Frequently Asked Questions (FAQ) document issued by the Gbenga Komolafe-led commission, NUPRC outlined the strategic goals of the licensing round.

These include increasing Nigeria’s oil and gas reserves, advancing local content development, attracting foreign direct investment (FDI), and contributing to long-term global energy security.

The commission also highlighted that the exercise was designed to enhance oil and gas production, promote gas utilisation, generate employment opportunities, and create value for both the Nigerian government and private investors.

Winners of the 50 Petroleum Prospecting Licences (PPLs) would have the right to dispose of crude oil or natural gas recovered during exploration or appraisal drilling, including production tests.

Licences would initially run for three years, with possible extensions of up to three additional years for onshore and shallow water blocks and five years for deepwater and frontier assets.

The licensing process would span eight months, commencing on November 17, 2025, and concluding on July 17, 2026.

NUPRC emphasised that the exercise is open to both local and foreign companies.

Foreign firms are not required to be registered in Nigeria prior to the bid, but any successful bidder must subsequently register under the Companies and Allied Matters Act (CAMA), as stipulated by the Petroleum Industry Act (PIA).

Applicants may be disqualified if they are indebted to the government, have previously failed to operate a licence or lease responsibly, or are insolvent.

The commission stressed two key considerations for selection: technical competence in upstream oil and gas operations and financial capacity.

Technical competence would be assessed across multiple areas, including geological and geophysical capabilities, drilling and well engineering, reservoir evaluation and management, production engineering, technology application, and development planning.

Bidders must submit a signature bonus within the approved range of $3 million to $7 million.

Any bid below this threshold would be deemed non-compliant and automatically excluded from evaluation.

Financial prerequisites include an average annual turnover of $100 million for deep offshore blocks and $40 million for onshore and shallow water blocks.

No bidder, whether applying individually or as part of a consortium, may submit applications for more than two assets.

Participation in multiple consortiums counts toward this limit, and any ownership in multiple consortiums will be aggregated as a single entity.

NUPRC also confirmed that newly formed companies, consortia, or special purpose vehicles can participate, provided their shareholders or members meet the pre-qualification criteria.

The commission dismissed claims that it was withholding the Frontier Exploration Fund (FEF) from the Nigerian National Petroleum Company Limited (NNPC Ltd).

Head of Media and Strategic Communication, Eniola Akinkuotu, clarified that $185,123,333 and N14.9 billion had been approved for release.

The fund is managed by the Central Bank of Nigeria, not the commission, which only evaluates NNPC’s work programme before authorizing disbursement.

“We approve funds based on certified activities and awarded contracts.

” If a contract has not been awarded, we cannot authorize payments,” NUPRC stated.

The regulator further revealed that PwC was engaged to verify NNPC’s claims prior to fund approval, ensuring transparency.

So far, NUPRC confirmed, there was no outstanding sum.

The final tranche of $140 million was approved for release on November 27, 2025, with earlier disbursements of $45 million and N14.9 billion already completed.

The commission noted that the fund was exclusively for NNPC use and warned against false claims by operators.

In addition, the Minister of State for Petroleum, Senator Heineken Lokpobiri, had previously denied any investigation into NUPRC regarding the fund, labeling reports of such an investigation as “mischief.”