Recapitalisation drive gains momentum as 16 banks clear capital bar ahead of deadline

With just about 100 days left to the March 31, 2026 recapitalisation deadline set by the Central Bank of Nigeria (CBN), the country’s banking sector is recording significant progress, as 16 financial institutions have already met the minimum capital requirements for their respective licence categories.

The development marks a major milestone in Nigeria’s most ambitious banking reform programme in more than a decade, aimed at strengthening financial stability and positioning lenders to better support economic growth.

Among the banks that have successfully met the required thresholds are Access Holdings, Zenith Bank, United Bank for Africa (UBA), Guaranty Trust Bank (GTBank), Ecobank, Stanbic IBTC, Wema Bank, Jaiz Bank, Lotus Bank, Providus Bank, Greenwich Merchant Bank and PremiumTrust Bank.

Others include Sterling Bank, Globus Bank, Citibank Nigeria and Nova Bank, bringing the total number of compliant institutions to 16.

Several other lenders, including Fidelity Bank and FCMB Group, are still at different stages of capital raising and regulatory verification.

These banks remain optimistic about meeting the deadline as they conclude ongoing fundraising efforts and await final approvals from regulators.

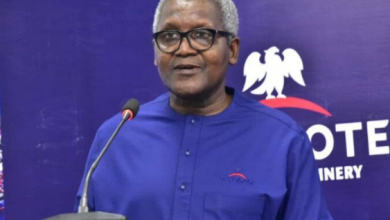

The CBN Governor, Mr. Olayemi Cardoso, said the apex bank’s priority is to ensure a smooth and orderly conclusion of the recapitalisation exercise while maintaining strict supervisory oversight.

According to him, the end goal is to emerge with a banking sector that is more resilient to economic shocks and better equipped to finance Nigeria’s development agenda.

Speaking at the U.S.–Nigeria Executive Business Roundtable held this week in Washington, D.C., Cardoso described the recapitalisation programme as a cornerstone of Nigeria’s broader financial sector reforms.

He said the initiative is designed to protect financial stability, expand banks’ lending capacity and ensure the financial system can effectively support economic transformation.

The CBN governor disclosed that, beyond the 16 banks that have already crossed the capital threshold, about 27 institutions have raised funds through a combination of public offers, rights issues, private placements and mergers.

He added that industry-wide stress tests conducted by the CBN show that the banking system remains fundamentally sound, liquid and resilient.

With roughly four months to the deadline, Cardoso noted that regulators are focused on ensuring compliance is achieved without disruption, while also improving transparency and strengthening governance across the sector.

He added that the banking reforms were being complemented by wider macroeconomic and foreign exchange measures designed to support Nigeria’s ongoing recovery.

Market analysts said the recapitalisation drive was entering a critical phase that could significantly reshape ownership structures across the banking industry.

While large-scale mergers and acquisitions have yet to take centre stage, analysts believe changes in shareholding are increasingly likely as banks seek new investors to bolster their capital positions.

FCMB Group, one of the lenders still finalising its recapitalisation process, confirmed that it has successfully completed its public offer and was on track to conclude the sale of a minority stake in one of its subsidiaries before the end of December.

The group said that, subject to capital verification by the CBN, shareholder approval and regulatory consents, it expects to meet the N500 billion capital requirement for its banking subsidiary, FCMB Limited, well ahead of the March 2026 deadline.

Experts said that while mergers remained limited for now, private placements and rights issues could lead to dilution for existing shareholders who are unable or unwilling to participate in capital-raising exercises.

This, they noted, could open the door to new investors and shifts in control within some banks.

According to the Head of Financial Institutions Ratings at Agusto & Co., Ayokunle Olubunmi, only a small number of banks are still struggling to meet the required thresholds.

He noted that merger and acquisition activity may become more pronounced early next year as the deadline approaches and pressure mounts on weaker players.

Olubunmi added that the recapitalisation exercise is already attracting fresh capital into the sector and strengthening its long-term outlook.

He said changes in partnership and ownership structures are inevitable as banks negotiate how much equity they are willing to give up in exchange for new funds.

As the countdown continues, industry observers said the success of the recapitalisation programme will play a critical role in determining the future strength, competitiveness and stability of Nigeria’s banking system.