Business

Diaspora Nigerians to enjoy easier access to financial services with NRBVN

The Central Bank of Nigeria (CBN) has unveiled a new platform that allows Nigerians in the diaspora to obtain a Bank Verification Number (BVN) remotely without the need for a physical presence in Nigeria.

The Non-Resident Bank Verification Number (NRBVN) platform is a collaborative effort between the CBN and the Nigeria Inter-Bank Settlement System (NIBSS).

According to the apex bank, this innovative digital gateway allows Nigerians in the diaspora to obtain a BVN remotely without the need for a physical presence in Nigeria.

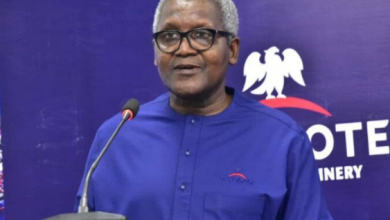

CBN Governor Yemi Cardoso described the initiative as a milestone in Nigeria’s financial inclusion journey and a critical bridge connecting the country to its global citizens.

He said, “For too long, many Nigerians abroad have faced difficulties accessing financial services at home due to physical verification requirements.

”The NRBVN changes that. Through secure digital verification and robust Know Your Customer (KYC) processes, Nigerians worldwide should now be able to access financial services more easily and affordably.”

Cardoso also emphasised the platform’s potential to increase remittance flows and reach the CBN’s one billion dollars monthly remittance target.

“We are building a secure, efficient, and inclusive financial ecosystem for Nigerians globally. This platform is not just about financial access, it is about national inclusion, innovation, and shared prosperity, ” hes said.

The NRBVN platform is designed to enhance the banking experience for Nigerians in the diaspora, providing secure and remote access to financial services.

According to Muhammad Abdullahi, CBN’s Deputy Governor, Economic Policy Directorate:

“The NRBVN stands as a transformative tool, meticulously designed to enhance the banking experience for our diaspora community..

”It is our firm belief that this initiative will not only strengthen economic ties, it will also foster a sense of pride and belonging among Nigerians worldwide, encouraging them to play an even greater role in our nation’s development, ” he said.

The NRBVN system has been built with global standards in mind, incorporating stringent Anti-Money Laundering (AML) and KYC compliance protocols to ensure the integrity, transparency, and security of Nigeria’s financial system.

Every NRBVN enrollment undergoes comprehensive verification checks to safeguard against illicit financial activity.

The platform is part of a broader framework that includes the Non-Resident Ordinary Account (NROA) and Non-Resident Nigerian Investment Account (NRNIA).

Together, they enable access to savings, mortgages, insurance, pensions, and investment opportunities in Nigeria’s capital markets.