Lead

UN inaugurates new forum to help debtor countries

A new mechanism, titled ‘Borrowers Forum’, offering debt-distressed countries a way to coordinate action and amplify their voice in the global financial system has been inaugurated.

The forum was inaugurated on Wednesday at the UN’s pivotal sustainable development conference in Sevilla, Spain.

The inauguration comes at a time of rising debt distress across the developing world.

The new forum is being supported by the UN and emerging as a key part of the Sevilla Commitment outcome document.

Rebeca Grynspan, Secretary-General of UN Trade and Development (UNCTAD), said developing nations often faced creditors as a united bloc while negotiating alone.

According to her, voice is not just the ability to speak, it’s the power to shape outcomes.

“Today, 3.4 billion people live in countries that pay more in debt service than they do on health or education.”

She said that the forum, one of 11 recommendations by the UN Secretary-General’s Expert Group on Debt, would allow countries to share experiences and receive technical and legal advice.

“It will also allow countries to promote responsible lending and borrowing standards, and build collective negotiating strength.

“Its inauguration will addresses long-standing calls from the Global South for more inclusive decision-making in a debt system dominated by creditor interests,” added

Global South finance and foreign ministers hailed the Borrowers’ Forum’ as a milestone in efforts to reform the international debt architecture.

UN Special Envoy on financing the 2030 Agenda, Mahmoud Mohieldin said the forum was a direct response to a system that has kept debtor countries isolated for too long.

“This is about voice, about fairness, and about preventing the next debt crisis before it begins,” he said.

The commitment, known in Spanish as the Compromiso de Sevilla, adopted by consensus at the conference, includes a cluster of commitments on sovereign debt reform, alongside support for borrower-led initiatives.

“It calls for enhanced debt transparency and improved coordination among creditors, as well as the exploration of a multilateral legal framework for debt restructuring.

It endorsed country-led debt sustainability strategies and debt payment suspension clauses for climate-vulnerable nations.

It also endorsed greater support for debt-for-nature and debt-for-climate swaps, although with stronger safeguards and evidence of impact.

However, civil society groups have sharply criticised the adopted outcome in Sevilla, calling it a missed opportunity to deliver meaningful reform of a global debt system that is crippling many developing nations.

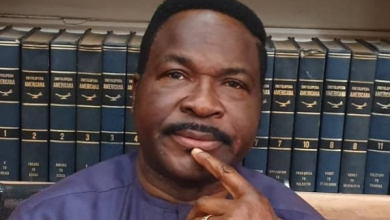

Jason Braganza of the African Forum and Network on Debt and Development, said the final outcome document adopted on day one, called the Sevilla Agreement, fell far short of what was needed.

“This document did not start with much ambition and still managed to be watered down.

“Nearly half of African countries are facing a debt crisis; instead of investing in health, education and clean water, they’re paying creditors,” he said.

Braganza however praised the leadership of the African Group and the Alliance of Small Island States, which fought for a UN Framework Convention on sovereign debt.

He also welcomed a small breakthrough in the form of a new intergovernmental process that could lay the groundwork for future reform.

NAN