CBN holds monetary policy rate at 27% amid inflation concerns

The Central Bank of Nigeria (CBN) has opted to maintain the country’s benchmark monetary policy rate (MPR) at 27 per cent, signaling a continued cautious approach to managing inflation and supporting financial stability.

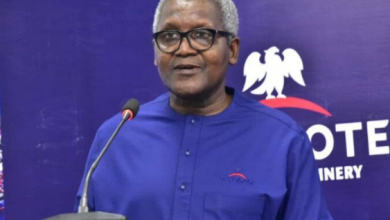

The decision was announced by CBN Governor Olayemi Cardoso following the 303rd meeting of the Monetary Policy Committee (MPC) in Abuja.

The MPR serves as the foundation for all other interest rates in the economy, influencing lending, savings, and investment across the country.

By keeping the rate unchanged, the MPC emphasized its commitment to sustaining a tight monetary stance to curb inflationary pressures.

The Committee also confirmed the Cash Reserve Ratio (CRR) at 45 percent for commercial banks, 16 percent for merchant banks, and 75 percent on non-TSA public sector deposits, while maintaining the Liquidity Ratio at 30 per cent.

The standing facilities corridor has been adjusted to +50/-450 basis points around the MPR to ensure flexibility in monetary operations.

Governor Cardoso noted that headline inflation has shown signs of moderation, attributing this to disciplined monetary policy, exchange rate stability, and relative consistency in petrol prices.

Nonetheless, he stressed that inflationary pressures remain elevated, requiring continued coordination between monetary authorities and fiscal policies to bring prices under control.

The MPC also highlighted significant progress in the recapitalisation of banks, with sixteen institutions meeting regulatory capital requirements, reflecting enhanced resilience in the financial sector.

On the international front, Cardoso observed that global economic recovery remains uneven, with lingering trade tensions expected to limit near-term growth.

Global inflation is projected to remain above pre-pandemic levels, necessitating vigilant policy measures.

The CBN governor reaffirmed the bank’s commitment to evidence-based policy, aimed at safeguarding price stability while promoting a resilient financial system capable of supporting sustainable economic growth.