Delta Govt launches N1bn revolving loan for MSMEs

The Delta State Government has released a N1 billion revolving loan to support Micro, Small, and Medium Enterprises (MSMEs) in the state.

The fund was officially launched in a ceremony at Government House, Asaba, and its management has been entrusted to the Bank of Industry (BoI) under a Memorandum of Understanding signed with the state government.

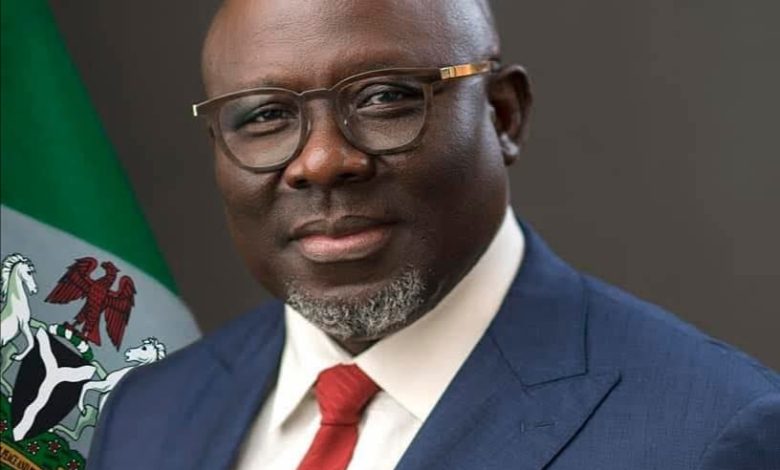

Governor Sheriff Oborevwori described the initiative as a milestone in his administration’s M.O.R.E Agenda, aimed at promoting inclusive growth, job creation, and sustainable economic development.

“MSMEs remain the backbone of any strong economy, providing the highest employment rate and driving growth.

“This fund provides traders, artisans, agro-processors, and small-scale manufacturers with access to capital at single-digit interest rates, enabling business expansion, job creation, and sustainable growth, ” he said.

The governor explained that the revolving structure of the fund ensures that loans are recovered and reallocated to other entrepreneurs, fostering accountability and financial discipline among beneficiaries.

Oborevwori also highlighted the choice of BoI to manage the fund, citing the bank’s expertise in credit appraisal, business support, and development financing.

He emphasised that the initiative complements, rather than replaces, existing government grants and empowerment programmes.

“While grants remain important, excessive reliance on them can undermine accountability.

”This loan-based model will instil financial discipline and help entrepreneurs invest wisely and grow sustainably,” the governor said.

The fund, initially scheduled for December, was launched in January to align with the period when entrepreneurs are actively rebuilding and expanding their businesses for the new year.

Oborevwori also suggested that the N1 billion could be scaled up significantly if the programme proves successful, potentially reaching N10 billion, N20 billion, or more.

Dr. Olasupo Olusi, Managing Director of the Bank of Industry, described the partnership as a strategic move to deepen access to affordable finance and unlock sustainable economic growth in Delta State.

He said the initiative aligned with BoI’s mandate of translating government policy priorities into practical financing solutions for key sectors of the economy.

The government expressed confidence that the revolving fund would strengthen MSMEs, expand enterprise activities, and build a more resilient private sector capable of driving long-term prosperity for the state.