CBN urges banks to slash electronic fraud losses

The Central Bank of Nigeria (CBN) has challenged banks and payment service providers to implement measurable reductions in electronic fraud, urging financial institutions to respond to suspicious transactions within 30 minutes under the Nigeria Electronic Fraud Forum (NeFF) framework.

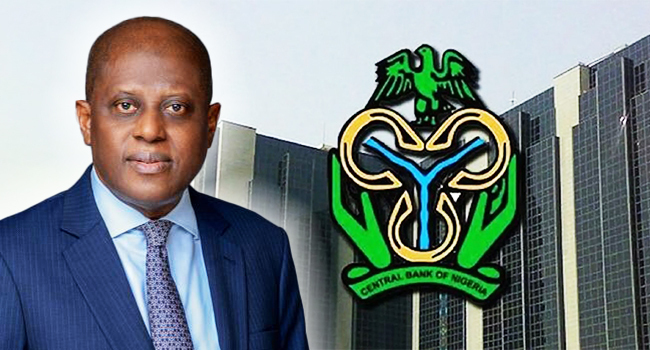

Speaking at the 2026 NeFF Technical Kick-Off Session, themed “Shrinking Fraud Losses with ISO 20022 and Identity Management,” Deputy Governor, Financial System Stability, Mr. Philip Ikeazor, stressed the need for the industry to move beyond fragmented controls and adopt enterprise-wide, data-driven fraud management systems capable of delivering tangible results.

According to him, “Fraud is not merely an operational issue; it is a financial stability concern.

“Unchecked fraud undermines trust in digital finance, threatens inclusion gains, and poses systemic risks. The task before us is collective and urgent, ” he said.

Ikeazor also outlined strategic priorities, including full use of ISO 20022 data, universal real-time identity verification, 24/7 fraud monitoring, structured liability-sharing frameworks, and robust performance measurement through transparent scorecards.

The deputy governor further highlighted the evolving threat landscape, noting that while legacy fraud such as ATM card cloning has been neutralized, newer risks including online fraud, social engineering, SIM-swap abuse, insider compromise, and authorised push payment (APP) scams, have emerged.

He said reducing fraud response times to under 30 minutes was critical to improving recovery outcomes and limiting systemic exposure.

He also emphasised the role of identity infrastructure in curbing fraud, citing the Bank Verification Number (BVN) and its integration with the National Identification Number (NIN) as effective tools against impersonation and synthetic identity fraud.

Continued collaboration with the National Identity Management Commission (NIMC) was described as central to strengthening payment system integrity.

Supporting the CBN’s push, Managing Director of Nigeria Inter-Bank Settlement System Plc (NIBSS), Premier Oiwoh, revealed that total fraud losses declined sharply by 51 per cent in 2025, falling from N52.26 billion in 2024 to N25.85 billion.

Reported fraud cases also dropped slightly to 67,518.

Oiwoh attributed the improvements to stronger regulatory collaboration, enhanced detection capabilities, and tighter internal controls.

He however, noted that social engineering remains the dominant fraud technique, while insider abuse is emerging as the biggest threat.

He also flagged declining fraud reporting down 34 per cent in the last quarter of 2025—as a concern, warning that non-reporting allows fraudsters to move between institutions undetected.

To address this, the Person of Interest Portal was launched, containing records of 13,417 individuals involved in fraud since 2019, accessible to law enforcement agencies.

The NIBSS chief highlighted the growing adoption of AI-driven cybersecurity tools and the National Payment Stack (NPS), which applies ISO 20022 standards and real-time risk scoring of instant payments to flag suspicious transactions.

Looking ahead, Oiwoh stressed that proper BVN and NIN validation can eliminate up to 95 percent of identity-related fraud, while financial literacy and access to affordable smartphones remain critical to digital inclusion.

CBN Director of Payment System Supervision and NeFF Chairman, Dr. Rakiya Yusuf, reiterated the importance of strict KYC, KYB, and CDD compliance and announced forthcoming inspections to ensure adherence to ISO 20022 standards.

“There is no KYC zero,” she said, warning institutions to address gaps in customer identity verification to prevent fraud and strengthen the integrity of Nigeria’s digital financial ecosystem.